Build A Brighter Future With Kerri's Credit Repair Services

Transform your financial landscape with Kerri's expertise in credit repair. Achieve the credit score you need for the home you want, with personalized strategies and compassionate support.

Unlock Your Financial Potential With Kerri’s Credit Repair Services

Break free from the constraints of past financial mistakes with personalized credit repair strategies. Kerri is here to guide you through every step, offering hope and practical solutions to improve your credit score and enhance your loan eligibility.

- Tailored Credit Improvement Plans: Each credit situation is unique, and Kerri crafts personalized plans to address your specific challenges and goals.

- Fast Track Credit Repair: Witness significant improvements in your credit score within just two months thanks to Kerri's effective strategies and guidance.

- No Additional Cost: Kerri's credit repair services are integrated into her commitment to helping you secure a loan, ensuring you receive expert advice without extra fees.

- Educational Resources: Gain valuable insights into managing your finances better. Kerri provides resources and tips to keep your credit score on the right track long after you've secured your home.

- Continuous Monitoring and Support: Kerri stays by your side, monitoring your credit progress and offering ongoing support to ensure you remain on the path to financial health.

- Direct Dispute Assistance: If inaccuracies on your credit report are holding you back, Kerri helps you dispute them directly, clearing the way for a stronger credit score.

How It Works: Credit Building And Repair

Wondering how to rebuild your credit and improve your financial health? Discover the process of credit repair, from assessing your credit situation to implementing strategies for long-term improvement, with personalized guidance and support.

1. Contact Me To Get Started

Take the first step towards rebuilding your credit by contacting me for a consultation. Together, we'll assess your credit situation and develop a personalized plan to improve your credit score.

2. Implementing Personalized Credit Repair Strategies

With my guidance, we'll implement tailored strategies to address negative items on your credit report and build positive credit habits. I'll provide ongoing support and guidance as we work towards improving your credit score.

3. Reaching Your Financial Goals

As your credit score improves, you'll gain access to better financial opportunities, such as lower interest rates and higher credit limits. With dedication and perseverance, you'll achieve the financial freedom and stability you deserve.

Begin Transforming Your Credit Now

Take the first step towards a brighter financial future. Get in touch with me for personalized credit repair strategies that open doors to better opportunities.

How I Can Help Rebuild Your Credit.

With my personal experience and dedication, I'll work tirelessly to repair and improve your credit score, providing guidance every step of the way. Let's transform your financial future and open doors to new opportunities together.

Personalized Credit Repair Strategies

No two credit situations are alike, which is why I offer tailored strategies to repair and rebuild your credit. With my personalized approach, we'll address your specific challenges and pave the way for a brighter financial future.

Rapid Results Guaranteed

Say goodbye to waiting months or even years to see improvements in your credit score. With my proven methods and dedication, I guarantee rapid results, empowering you to take control of your financial health and achieve your goals sooner than you think.

Ongoing Support And Guidance

Building good credit is a journey, not a destination. That's why I provide ongoing support and guidance, helping you maintain and strengthen your credit long after our initial work is complete, ensuring lasting financial success.

Here's some quick links

Find what you need fast with these handy links. From learning more about me to exploring services and resources, everything is just a click away. Let's make your journey to homeownership as smooth as possible!

Non Resident Loans

Get pre-approved quickly and navigate the buying process with ease as a non resident.

First-Time Homebuyers

Get pre-approved quickly and navigate the buying process with ease, perfect for first-time homebuyers.

Credit Building And Repair

Boost your credit score with expert guidance and strategies tailored to improve your financial standing.

Self-Employment Loans

Get pre-approved quickly and navigate the buying process with ease as a non resident.Tailor-made loans for self-employed individuals, using simplified documentation for a smoother approval process.

Removing Someone From Your Mortgage

Smoothly transition ownership with our specialized services, ensuring a fair and stress-free process for all parties involved.

Home Equity Lines Of Credit (HELOC)

Access funds based on your home's equity with flexible credit lines, ideal for ongoing or large expenses.

Home Equity Loans

Tap into your home's value for significant projects or expenses with competitive rates and quick fund access.

Refinances

Lower your payments or cash out equity with tailored refinancing options that meet your financial goals.

Investment Loans

Expand your portfolio with loans designed for buying rental properties, offering guidance and competitive rates.

New Homebuyers

Explore a variety of home purchase options, including land and construction loans, to find the perfect fit for your dream home.

Frequently Asked Questions About Credit Building And Repair

Rebuilding your credit can seem daunting, but with the right guidance, it's entirely achievable. Here are answers to some common questions about credit repair to help you take control of your financial future.

With our credit repair services, many clients see significant improvements in their credit scores within two months.

Our credit repair services are offered at no additional cost as part of our commitment to helping you secure a loan.

Yes, we specialize in working with clients with less-than-perfect credit and can advise on the best steps to take for loan approval.

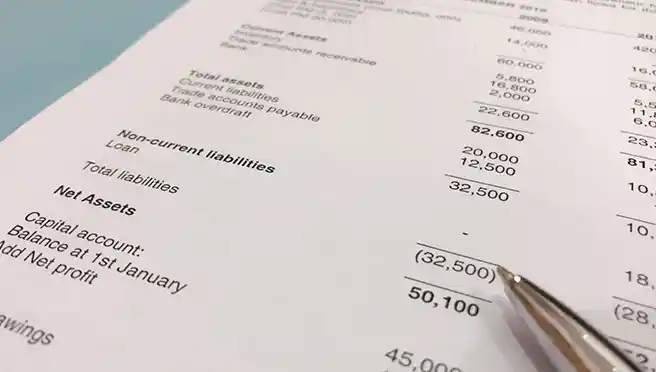

Credit repair involves assessing your credit report, identifying areas for improvement, and implementing strategies to boost your score.

While credit repair significantly improves your chances, loan approval will also depend on other factors like income and debt-to-income ratio.

Still have questions?

Click the button below to fill out a contact form or call us directly at (469) 771-8227

Improve Your Credit, Improve Your Life

Don't let past credit challenges hold you back. Contact me today, and let's work together to boost your credit score and achieve your financial goals.